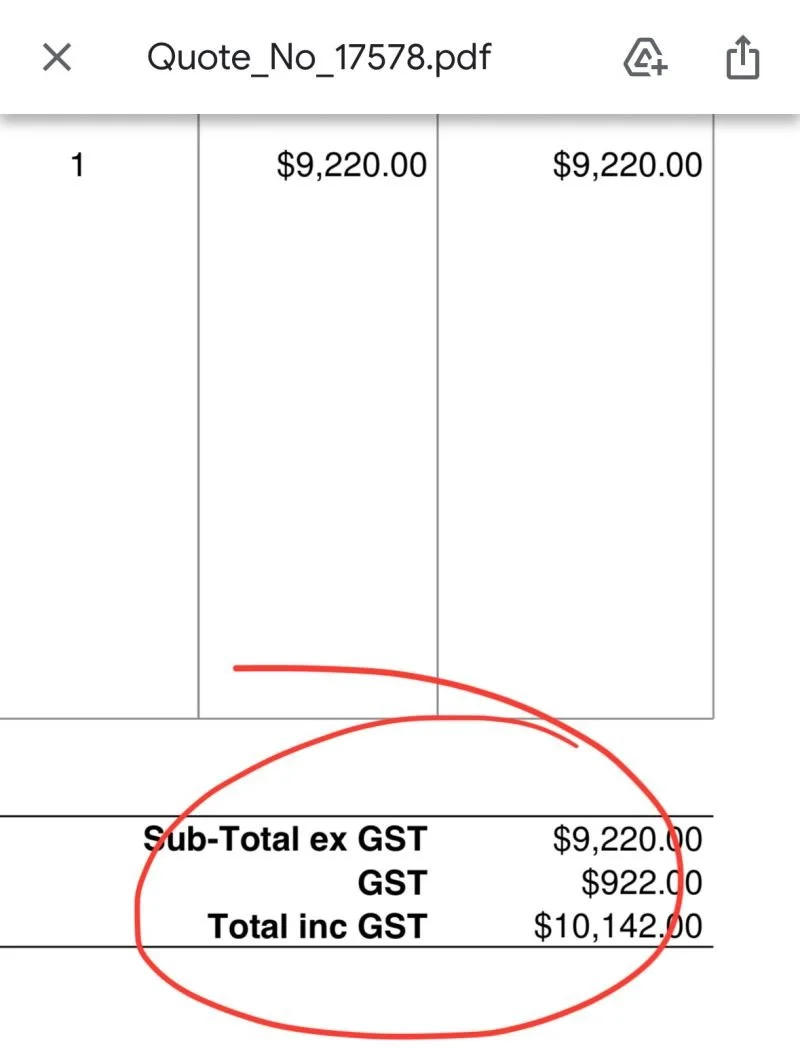

The $10,142 Repair Bill That Smacked Me This Morning

Invoice for $10,142 worth of repairs

I woke up this morning to a $10,142 repair bill.

A lovely way to start the day.

And a nice reminder of the not-so-sexy side of property investing.

What made it more interesting was that the building inspector didn’t flag the bathrooms as defective when I bought the place. Nothing urgent. Nothing concerning. No red flags at all.

I’m not angry about it - although I am in some mild physical pain - because this is just how property works sometimes. Things don’t always go exactly to plan, and that’s part of the game.

If you hold property long enough, expenses like this will eventually come knocking. It’s not a matter of if, just when.

Seven Years of Smooth Sailing… Until It Wasn’t

Across more than seven years of owning this property, I’ve barely had to spend a cent on repairs.

And by repairs, I don’t mean renovations, improvements, upgrades or anything that adds value. I mean pure “something broke, please fix it” repairs.

Then suddenly, over the last twelve months, I’ve spent more on repairs than I did in the previous six years combined. No real reason. No big structural disasters. Just the usual wear, tear, age and timing catching up all at once.

It happens.

The Realities No One Shows You

This is the part of property investing people rarely talk about. It’s not glamorous, there’s no equity glow-up, and it definitely doesn’t belong on a highlight reel - but it’s real.

Roof issues, plumbing issues, waterproofing failures, electrical surprises… every investor encounters some version of this over time. The longer you hold, the more likely you’ll see a few chunky invoices.

It doesn’t mean you bought a bad property.

It doesn’t mean your strategy is wrong.

It just means you’re in the arena.

As Frank Sinatra Says…

“That’s life.”

Some seasons are smooth. Others test your patience - and your bank account. But the long-term returns make it worthwhile, and the occasional sting is part of the cost of playing the game.

The key is being prepared for it, not shocked by it.

Author

Written by JP Ghabriel

Founder & Buyer’s Agent — Investr.

7.2M+ personal property portfolio

50+ client purchases

Helping Australians build long-term wealth through fundamentals-driven investing.